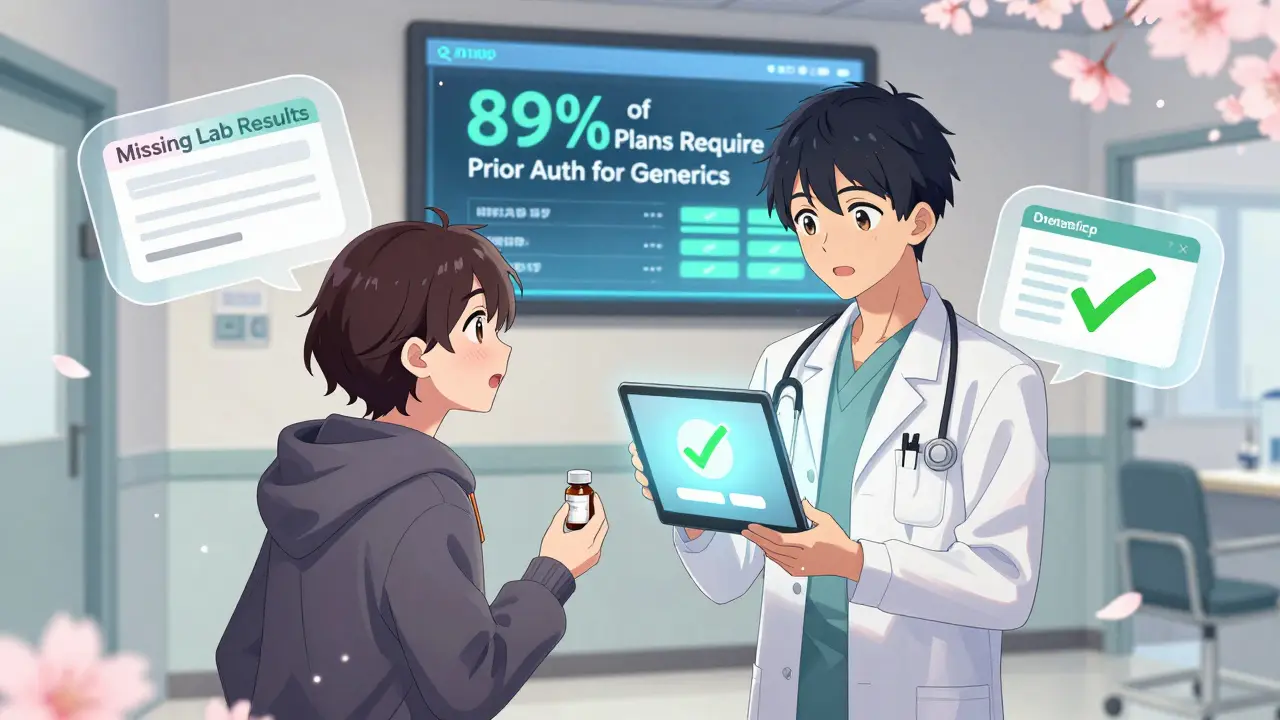

When a doctor prescribes a generic medication, many assume it’s a simple step-fill the script, pick it up, and go. But for providers, that’s rarely the case. Generic medications are supposed to be cheaper, safer, and just as effective as brand-name drugs. Yet, getting them approved through insurance often feels like navigating a maze with changing rules. In 2024, nearly 9 in 10 commercial health plans still require prior authorization for at least some generics. That’s up from 76% just five years ago. Why? Because insurers and pharmacy benefit managers (PBMs) use prior authorization as a tool to control costs. But for providers, it’s become a daily grind.

According to the Academy of Managed Care Pharmacy, 28% of all prior authorization requests involve generic drugs. That’s not because they’re risky - it’s because insurers are trying to steer patients toward the cheapest version, even if it’s not the best fit.

Providers who use standardized templates for common scenarios - like diabetes, acid reflux, or hypertension - see approval times drop by 32%. That’s because they’re not starting from scratch every time.

| Medication Type | Average Approval Time | Auto-Approval Rate |

|---|---|---|

| Generic Medications | 1-3 business days | 41% |

| Brand-Name Medications | 3-7 business days | 18% |

Why the difference? Generics are cheaper, so insurers are more likely to approve them if the clinical case is solid. But they’re also more likely to be restricted because there are so many versions. If a patient has been on one generic for years and the pharmacy switches to another, the payer may require re-approval - even if the active ingredient is identical.

Dr. Michael Chen, a gastroenterologist, successfully got approval for omeprazole 40mg daily for 12 weeks for a patient with Barrett’s esophagus. He submitted the endoscopy report showing intestinal metaplasia. It took two days via CoverMyMeds. No call. No back-and-forth. Just clear evidence.

But Dr. Lisa Rodriguez wasn’t so lucky. She prescribed generic sitagliptin after a patient had severe GI side effects from metformin. The insurer denied it, saying she needed to try three other drugs first - even though the American Diabetes Association says metformin intolerance is a valid reason to switch. The patient waited three weeks. By then, their blood sugar was dangerously high.

These stories aren’t rare. A survey of 1,200 pharmacists found that 83% have had patients unable to afford to pay out-of-pocket for a generic while waiting for approval. That’s not just inconvenient - it’s dangerous.

Training new staff takes 2-3 weeks. But those who learn the system say it’s worth it. One clinic reduced denials by 54% in six months by implementing templates and assigning one person to manage all prior auths.

The industry is shifting. As of July 2024, Medicaid managed care plans must use standardized electronic transactions. That’s expected to cut processing times by 25%. PBMs like Express Scripts are increasing auto-approvals for generics when quantity limits aren’t exceeded - up 40% in 2023 alone.

By 2026, McKinsey predicts 75% of generic prior auth decisions will be handled by AI systems. That means faster approvals - but also more rigid rules. If the algorithm says “no,” it might not care that your patient has a rare allergy to the preferred generic.

The American Medical Association is pushing for laws that eliminate prior authorization for generics that have been on the market for over five years and have multiple manufacturers. That’s a smart move. If a drug has been used safely by millions, why make providers jump through hoops?

Here’s what works now:

Generics are supposed to make healthcare cheaper and simpler. But right now, the bureaucracy around them makes them harder to access than brand-name drugs. Providers are stuck in the middle - trying to do what’s best for patients while fighting a system that doesn’t always see them as people.

No. Many generics are covered without prior authorization, especially if they’re on the plan’s preferred drug list. But 89% of commercial plans and 93% of Medicare Part D plans require prior auth for at least some generics - usually when there are multiple options, quantity limits, or off-label use. Medicaid plans vary by state, but 67% require it for select generics.

It depends. Electronic submissions with complete documentation typically take 1-3 business days. If the request is incomplete or requires manual review, it can stretch to 7-14 days. Urgent cases (like a patient without medication) should be approved within 24 hours under Medicare rules. Medicaid must respond within 14 days for non-urgent requests.

Generics are cheaper and have proven safety profiles, so insurers are more likely to approve them if the clinical case is clear. Brand-name drugs often require proof that cheaper options failed first. But generics face more restrictions because there are so many versions - insurers want to steer patients toward the cheapest one, even if it’s not the patient’s usual brand.

Sometimes. Some providers give short-term bridge prescriptions or work with pharmacies to offer a limited supply at a discounted rate. But 56% of physicians report having to do this because delays are common. Many patients can’t afford to pay out-of-pocket - 83% of pharmacists have seen patients go without medication while waiting.

Missing or incomplete documentation. Nearly half of all denials (42%) happen because the provider didn’t include enough clinical evidence - like lab results, diagnostic reports, or past medication history. The second most common reason is failing to try the plan’s preferred generic first, even if the patient had a bad reaction to it.

Yes. The Improving Seniors’ Timely Access to Care Act (2023) requires Medicare Advantage plans to respond to 90% of requests within 72 hours for standard cases and 24 hours for urgent ones - effective January 2024. Medicaid now requires standardized electronic transactions. And the AMA is pushing state laws to eliminate prior auth for generics that have been on the market over five years with multiple manufacturers.

Sam Dickison

7 02 26 / 06:49 AMLet’s be real - prior auth for generics is just insurance bureaucracy dressed up as cost control. I’ve spent hours on CoverMyMeds just to get a 5-dollar prescription approved. The system doesn’t care if the patient’s been on the same generic for 7 years. If the pharmacy switched manufacturers? Boom - new form. No logic. Just workflow.

And don’t get me started on the documentation. You need a full lab panel, three progress notes, and a signed affidavit from the patient’s dog to get approval. Meanwhile, brand-name drugs get auto-approved if they’re $400 a month.

It’s not about safety. It’s about steering. PBMs don’t want you prescribing what works. They want you prescribing what’s cheapest - even if it’s not the same molecule the patient’s body actually tolerates.

Karianne Jackson

9 02 26 / 01:25 AMThis is why I hate healthcare.

Tom Forwood

9 02 26 / 20:07 PMYo, I’m a med student in Texas and this hits HARD. My rotation at the VA? We had a guy on omeprazole for 5 years. Pharmacy switched to a different generic. He got a 2-week supply of nothing. His acid reflux went nuclear. Ended up in the ER. They finally approved it after 11 days. He cried. I didn’t know med school could be this emotional.

Also - shoutout to the clinic that uses Google Sheets for payer rules. That’s genius. I’m stealing that. My attending says ‘just fax it’ but bro, faxing in 2024 is like using a typewriter to send a tweet.

And AI? Yeah, I’m scared. What if it says ‘no’ because your patient’s BMI is 28.7 and the algorithm thinks ‘mild obesity = bad compliance’? We’re not robots. Patients aren’t data points.

Jacob den Hollander

10 02 26 / 21:54 PMMan… I just want to say - thank you. For writing this. For putting it out there. I’m a PA in rural Ohio, and every day feels like fighting a war with paper towels and a stapler.

I’ve had patients skip doses because they couldn’t afford to pay $120 out of pocket for a 30-day supply while waiting for approval. One lady? She stopped her blood pressure med. Had a stroke. We got the prior auth approved 3 days later. Too late.

I’m not mad. I’m just… tired. And I think a lot of us are. We didn’t go into medicine to be insurance clerks. But here we are. And we’re still showing up.

If you’re reading this and you’re a provider - you’re not alone. If you’re a patient - I’m sorry. This isn’t how it’s supposed to be.

Andrew Jackson

11 02 26 / 19:43 PMIt is an inexcusable abrogation of fiscal responsibility for any government-sanctioned entity to permit the unregulated dispensation of generic pharmaceuticals without stringent prior authorization protocols. The American taxpayer is being systematically exploited by pharmaceutical monopolies masquerading as generic manufacturers.

Without these gatekeeping mechanisms, the entire healthcare cost structure would collapse under the weight of uncontrolled utilization. One must ask: if a drug is so cheap, why is it being overprescribed? The answer is obvious - moral hazard.

Furthermore, the notion that ‘patients know best’ is a dangerous fallacy propagated by emotionally manipulative media. Clinical judgment, not patient preference, must govern therapeutic decisions. This is not a democracy. It is a medical ecosystem.

Frank Baumann

11 02 26 / 22:12 PMI’ve seen this. I’ve lived this. I’ve cried over this. I had a patient - 68-year-old woman, diabetic, on generic metformin for 8 years. Her pharmacy switched her to a different generic. She got dizzy. Her legs went numb. She called me. I called the insurer. They said ‘try the preferred one first.’ She couldn’t afford to pay $150. She didn’t take it. Two weeks later, her HbA1c was 14. She lost a toe. I’m not exaggerating. She lost a toe.

And now? Now I have to write a 17-page appeal with lab results, foot exam photos, and a notarized letter from her pastor. Because apparently, God’s testimony counts more than a blood glucose log.

This isn’t healthcare. This is a horror movie where the monster is a spreadsheet.

Tasha Lake

12 02 26 / 06:24 AMQuick question - when a plan requires trying ‘the preferred generic’ first, is that always the cheapest one? Or is it the one the PBM has a kickback deal with? Because I’ve seen cases where the ‘preferred’ generic is $0.05 more per pill than the one the patient was on… and the insurer still won’t budge.

Also - how many of these prior auth denials are actually reversed on appeal? Is there data on that? I feel like if we knew the reversal rate, we’d realize this whole system is just a tax on provider time.

Alex Ogle

14 02 26 / 00:37 AMI’ve been in this game 18 years. I’ve seen prior auth go from fax machines to AI bots. The tools got faster. The rules got worse.

Generics are supposed to be simple. They’re not. The system isn’t broken. It was designed this way. To slow things down. To make providers feel powerless. To make patients give up.

I used to fight. Now I just prescribe what the insurance wants - even if I know it’s not right. I’ve stopped caring. That’s the worst part.

Brandon Osborne

14 02 26 / 17:29 PMY’all are whining too much. This is capitalism. If you can’t handle paperwork, go work at Starbucks. You think doctors are the only ones with red tape? Try filing taxes. Try getting a mortgage. Try getting a damn visa.

Stop acting like you’re entitled to free, effortless care. Insurance companies aren’t evil. They’re just doing their job - protecting shareholder value. If you want to change the system, stop prescribing and start lobbying. Or better yet - stop being a doctor. Let someone who actually wants to do paperwork handle it.

Brett Pouser

15 02 26 / 00:55 AMReal talk: I’m a pharmacist in Georgia. I see patients every day who show up with a prescription and say ‘I can’t afford this.’ I have to tell them ‘It’s approved - but you have to wait 10 days.’

Some of them just walk out. No meds. No explanation. Just silence.

I keep a stash of free samples. I’ve given away over 200 doses of generic lisinopril this year. I don’t get paid for it. I don’t get thanked. But I do it anyway.

Because if I don’t… who will?

Andy Cortez

16 02 26 / 11:07 AMLOL. Prior auth for generics? Bro, the real problem is that people still think generics are ‘just as good.’ They’re not. The FDA lets ‘equivalent’ be 80-125% bioavailability. So your ‘generic’ could be 25% weaker. Or 25% stronger. That’s not medicine. That’s Russian roulette.

Also - who even uses CoverMyMeds anymore? I use a guy named Dave who works at Humana. He texts me back. We talk about football. He approves everything. That’s how you do it. Build relationships. Not templates.

And yeah - AI is coming. And it’s gonna be beautiful. Machines don’t care if you cried. They just say ‘DENIED.’

Joseph Charles Colin

16 02 26 / 17:33 PMFrom a clinical informatics standpoint, the bottleneck isn’t the prior auth process - it’s the lack of interoperability between EHRs, PBMs, and payers. We’re still using HL7 v2.5 messages over FTP. The average prior auth submission contains 47 fields. Only 18 are clinically relevant. The rest? Administrative noise.

Standardized FHIR APIs could reduce submission time by 68%. But PBMs won’t adopt them because they rely on manual review to generate revenue from appeals. It’s not a system failure. It’s a business model.

Also - 42% of denials are due to incomplete documentation? That’s because providers are overwhelmed. Not negligent. The system doesn’t account for cognitive load. We need intelligent pre-population - not more checkboxes.

PAUL MCQUEEN

17 02 26 / 13:43 PMWhy are we even talking about this? The answer is obvious: people don’t want to pay for healthcare. So they pretend generics are ‘free.’ They’re not. Someone’s paying. It’s just not you. Stop pretending this is about patients. It’s about money. And the money’s always on the other side.

Also - ‘brand-name drugs take longer’? That’s because they’re expensive. Of course insurers make you jump through hoops. That’s not a bug. That’s the feature.

glenn mendoza

18 02 26 / 05:35 AMIt is with profound humility and deep respect for the tireless dedication of frontline clinicians that I acknowledge the systemic burdens imposed by the current prior authorization framework. The administrative overhead exacts a measurable toll on provider well-being, clinical autonomy, and ultimately, patient outcomes.

While fiscal prudence is a necessary component of sustainable healthcare delivery, it must not be pursued at the expense of human dignity. The data presented herein - particularly the 16.1 hours per week spent on prior auth - constitutes not merely inefficiency, but a moral imperative for reform.

I urge policymakers, administrators, and industry leaders to prioritize patient-centered, evidence-based pathways that eliminate discretionary barriers for established, low-risk generic therapeutics. The time for change is not tomorrow. It is now.

John Watts

19 02 26 / 14:16 PMHey - I’m a nurse practitioner in Arizona. I started a ‘Prior Auth Support Group’ at my clinic. We meet every Thursday. We vent. We share templates. We celebrate wins. Last week, we got 14 approvals in one day. We did a little dance. We ordered pizza. We cried. We laughed.

This job is hard. But we’re not alone. And if you’re reading this and you’re drowning - reach out. We’ve got your back. You’re not just a provider. You’re a hero. And we see you.

Sam Dickison

20 02 26 / 00:09 AMJust got a denial today. Same patient. Same drug. Same reason. ‘Not preferred.’ I called the PBM. The rep said, ‘We can’t override. But if you send a letter from the patient’s therapist, we might reconsider.’

Therapist. For a blood pressure med.

That’s not healthcare. That’s performance art.